TMS Software Unbundling Revolution 2026: How European Shippers Can Build Best-of-Breed Logistics Ecosystems and Cut Integration Costs by 40% Through Strategic API Architecture

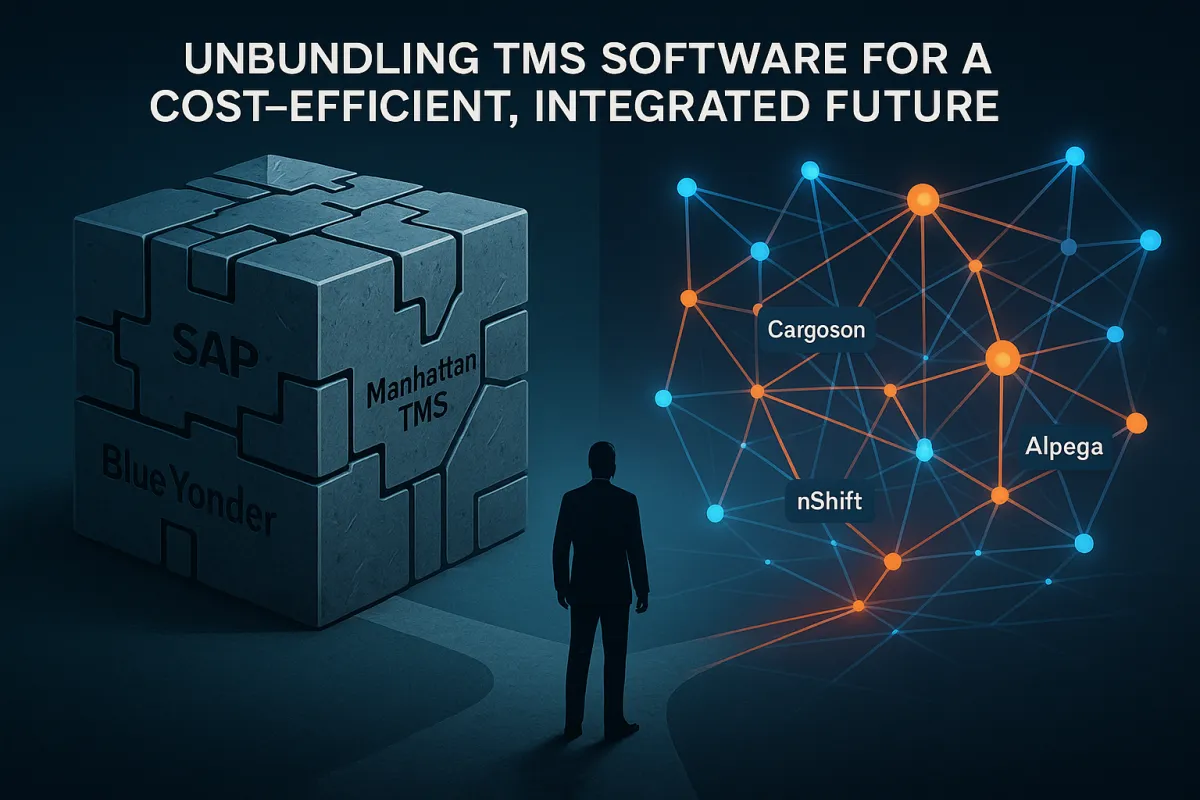

European shippers managing 20+ carrier relationships face a fundamental choice in 2026: continue wrestling with monolithic TMS platforms that cost €300,000+ annually to implement, or leverage the rapid spread of API connections that has started to make it easy, reliable and cheap for systems to connect with and transfer data between each other, as "the API-fication of TMS has evolved far beyond where it was just a few years ago." We see many mid-sized and large fleets to move away from an all-in-one TMS-accounting bundle to using a best-in-class, professional accounting system and a best-in-class transportation management system.

This TMS software unbundling revolution represents more than just a technology trend. The European TMS market, valued at €1.4 billion in 2024 and growing at a compound annual growth rate of 12.2 percent, is forecasted to reach €2.5 billion by 2029. Yet behind these impressive growth numbers lies a strategic inflection point that procurement teams are missing.

The Software Unbundling Revolution Reshaping European TMS Procurement

Tasks that once required custom development, like connecting a TMS to an ERP system, are easier because of more mature application programming interfaces (APIs) and standardized data flows. What started as a technical evolution has become an economic imperative.

Consider the traditional approach: SAP Transportation Management might cost you €200,000-€1,000,000+ annually, Manhattan TMS requires months of implementation, and Blue Yonder demands enterprise-level commitments. These platforms force you into their entire ecosystem, whether you need all those capabilities or not.

TMS connectivity has improved significantly, with vendors shipping more prebuilt connectors and cleaner links between TMS applications and enterprise systems. This technical maturity enables a different procurement strategy: assemble best-of-breed components that excel in their specific domains rather than accepting compromise across all functions.

The math becomes compelling quickly. Instead of paying for enterprise accounting modules you'll never use, you can connect a specialized transportation system like Cargoson, nShift, or Alpega directly to your existing SAP or Microsoft Dynamics installation. The API connections handle data synchronization automatically, eliminating manual double-entry while maintaining system flexibility.

Why All-in-One TMS Platforms Are Losing Ground to API-Native Solutions

The limitations of monolithic systems become apparent during implementation. Product roadmap uncertainties are already surfacing. When two TMS platforms merge, customers inevitably face decisions about which system to standardize on, what features will be deprecated, and how long dual support will continue.

Take the recent consolidation wave: Körber Supply Chain Software acquired MercuryGate International Inc., creating what is now known as Infios, while WiseTech's strategic acquisition of E2open combines two of the most acquisitive players in this space. Customers now face uncertainty about feature conflicts, integration roadmaps, and support structures.

API-native platforms sidestep these risks through modular architecture. When Alpega updates their European carrier network or nShift enhances their parcel capabilities, you benefit immediately without worrying about system-wide compatibility issues. Users benefit from simplified user interfaces, pre-configured workflow templates and modular capabilities, with modular architecture enabling companies to start with a small solution but expand their use.

This modularity extends to pricing models. Traditional enterprise TMS platforms bundle carrier connectivity, warehouse management, and financial modules into single contracts. Consider these TCO components: base licensing (20-30% of total), implementation services (25-40%), carrier integration (15-25%), customization and training (10-20%), and ongoing support (15-20%). Best-of-breed solutions let you pay only for capabilities you actually need.

The European Advantage: Regulatory Complexity Driving Specialization

European transport operations face regulatory complexity that favors specialized solutions over generic platforms. The European market typically has differentiated itself as a challenging region due to the existing fragmentation of its carrier networks, the complexity of the tariff system used by some carriers based on multiple factors and the strong localization of systems, requiring deep integration with local carriers in each market, support for country-specific documentation requirements, and real-time customs and border processing capabilities.

Since January 2024, the European Union's Emissions Trading System has required verified carbon emissions reporting for all cargo and passenger vessels over 5,000 gross tons visiting EU ports. This development forces shippers to gather, monitor, and annually report their emissions, with regulatory coverage expected to increase from 40% in 2024 to full compliance by 2026.

The eFTI regulation takes effect across EU member states throughout 2025-2026, requiring standardized electronic freight transport information. CBAM (Carbon Border Adjustment Mechanism) transitions from transitional to full enforcement in 2026, demanding detailed emissions tracking across supply chains.

Specialized European TMS providers like Cargoson, Alpega, and nShift build compliance capabilities directly into their core platforms. They understand CMR documentation requirements, handle multi-country VAT calculations, and maintain updated customs code databases. Generic enterprise platforms treat European compliance as customization projects that cost extra and take months to implement.

Building Your Best-of-Breed TMS Architecture: A Strategic Framework

Start by mapping your current system landscape. Document existing ERP connections, carrier relationships, and manual workflows. Implementation costs vary dramatically based on your operational complexity. Automation requires setup of connections with internal systems like ERP, plus external carriers for booking, tendering, status messages, and invoicing - and if you work with several carriers, this can be significant.

Evaluate core versus peripheral functions. Your TMS should excel at transportation planning, carrier management, and shipment execution. Accounting, inventory management, and customer relationship functions might be better served by existing enterprise systems that already integrate with your business processes.

Consider core TMS functionality from your primary vendor with specialized modules (carbon tracking, customs management, carrier connectivity) from best-of-breed providers that integrate via APIs. This approach provides flexibility while maintaining functional coherence.

For European shippers, carrier network access becomes the primary selection criterion. Alpega connects to 80,000+ transport professionals across Europe, while nShift provides 1,000+ true carrier API/EDI connections, primarily focused on parcel carriers. Cargoson focuses specifically on European mid-market shippers with direct API/EDI integrations rather than marketplace connections.

The decision framework involves three key considerations:

Integration Complexity: How many systems need to connect? Many carriers aren't willing or able to create API connections, and even when they are, they'll charge integration costs to you. European shippers working with 20-30 regular carriers face substantial connectivity expenses that vendors rarely discuss during initial demos.

Operational Scale: The SMEs segment is growing the fastest because of the increased availability of cloud-based TMS platforms that offer SaaS pricing models with no upfront IT cost, with adoption being accelerated due to the short deployment cycle of 3-6 months for many of the cloud-based TMS systems.

Geographic Scope: Multi-country operations require platforms that understand European regulatory complexity, not just technical API capabilities.

API Integration Strategy: Connecting Best-of-Breed Components

Modern TMS integration goes beyond simple data transfer. Integration with the ERP system enables a seamless flow of data regarding orders, invoices, and warehouse stock levels. As a result, the TMS can automatically process transport orders, issue waybills, and update financial data in real time.

Authentication and rate limiting become crucial when connecting multiple systems. Each API connection requires monitoring for uptime, data quality, and performance. European carriers often implement rate limits on API calls, requiring your integration strategy to handle throttling gracefully.

Consider webhook implementations for real-time updates versus polling mechanisms that batch data transfers. Shipment status updates, delivery confirmations, and exception alerts need immediate processing, while rate updates and capacity information can operate on scheduled intervals.

Integration with telematics systems provides the TMS with real-time information about vehicle location, speed, fuel consumption, and driver behavior. This data is crucial for monitoring delivery progress, estimating the estimated time of arrival (ETA), and optimizing routes in real-time.

The API management strategy should include:

Version control for carrier API changes, which happen frequently in the European market. Document change notification processes and maintain backward compatibility during transition periods.

Error handling and retry logic for temporary connectivity issues. European carrier systems experience planned maintenance windows that your integration must handle gracefully.

Data validation and cleansing at integration points. Different carriers provide status updates in varying formats that require normalization for consistent reporting.

Cost-Benefit Analysis: Unbundled vs All-in-One TCO Models

The financial comparison reveals significant differences over 3-5 year periods. Traditional TMS systems cost €100,000+ annually and take months to install, while modern cloud platforms offer faster deployment and transparent pricing with some traditional systems requiring €100,000+ annual commitments.

Consider a mid-sized European manufacturer shipping 5,000 orders monthly across 25 carriers:

All-in-One Enterprise Approach: SAP TM or Manhattan TMS licensing: €150,000-€400,000 annually Implementation services: €200,000-€500,000 Carrier integration costs: €5,000-€15,000 per carrier Annual support and maintenance: €50,000-€100,000 Total Year 1: €700,000-€1,240,000

Best-of-Breed Modular Approach: Cloud-native TMS (Cargoson, nShift, Alpega): €20,000-€80,000 annually ERP integration development: €15,000-€30,000 one-time Pre-built carrier connections: Often included or €1,000-€3,000 per carrier Implementation and training: €10,000-€25,000 Total Year 1: €70,000-€185,000

The 40% cost reduction mentioned in our title comes from eliminating unused enterprise features, faster implementation timelines, and transparent pricing models that don't require extensive customization projects.

Cargoson and other modern European TMS providers often include implementation support in their pricing models, contrasting with traditional enterprise vendors who separate these services. This bundling approach reduces project risk and provides more predictable budgets.

Future-Proofing Your Logistics Technology Stack Through 2030

Expect to see more traction in this area in 2026 as workflow-focused platforms add more agentic AI features that can sit on top of core systems like ERP. Once in place, these advanced systems can help supply chain and logistics managers orchestrate complex processes.

The European regulatory landscape continues evolving with sustainability requirements, digital documentation standards, and cross-border compliance frameworks. Modular architectures adapt to these changes more easily than monolithic platforms that require system-wide updates.

Rapid AI & ML maturation means AI-powered TMS modules are now capable of handling complex decisions, from load matching to disruption response, with 2026 standing out as the most likely year when full TMS automation becomes mainstream.

The strategic advantage goes to companies that build technology stacks around APIs and data standards rather than vendor lock-in. When new capabilities emerge—whether AI-powered optimization, blockchain-based documentation, or IoT sensor integration—modular architectures can adopt them selectively without replacing entire systems.

The European TMS vendor consolidation of 2025 represents both challenge and opportunity. Companies that understand the new landscape, evaluate vendors based on post-consolidation criteria, and implement with appropriate risk mitigation will emerge with competitive advantages, as the vendor landscape will look dramatically different by 2026.

Your procurement decision today determines your competitive position through 2030. The question isn't whether to modernize your TMS infrastructure, but whether to bet on flexibility and specialization or accept the limitations and costs of monolithic platforms. European shippers choosing the best-of-breed path now will adapt faster to regulatory changes, integrate new technologies more easily, and maintain better cost control as their operations scale.

The software unbundling revolution has arrived in European logistics. The companies that recognize this shift and act strategically will build the foundation for the next decade of competitive advantage.