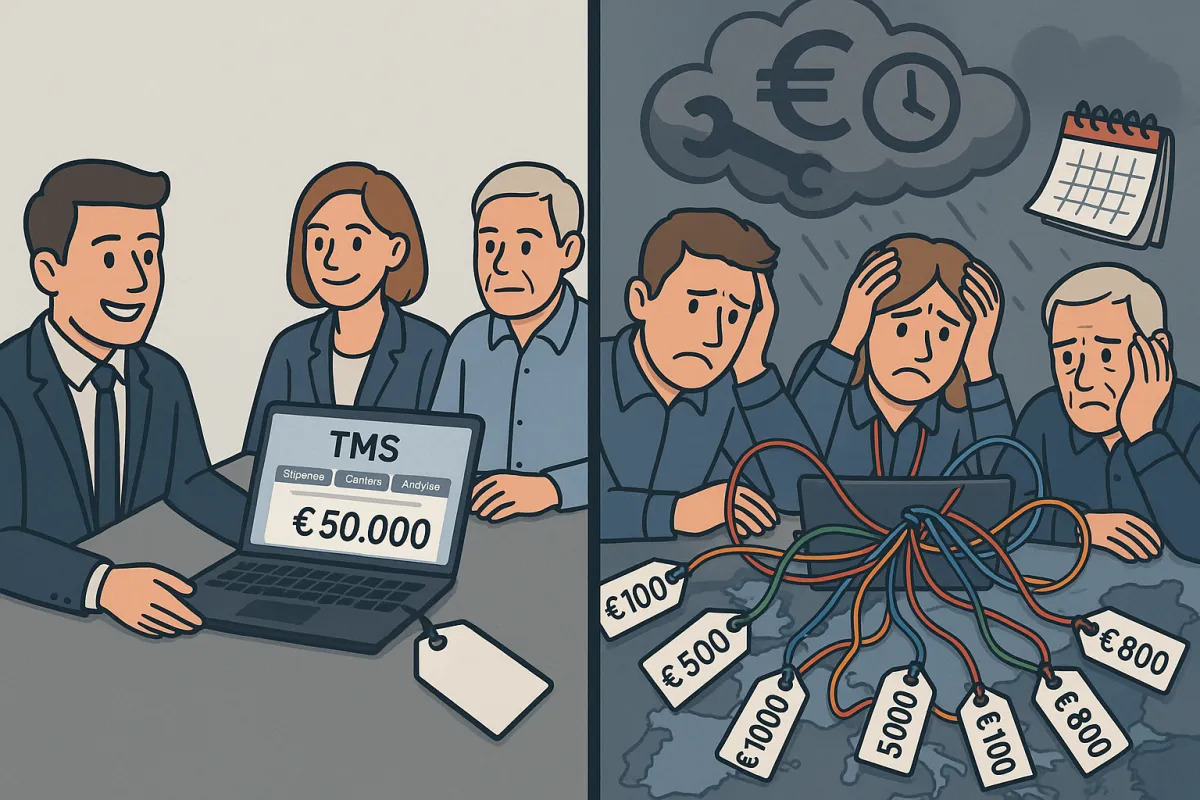

The €800K TMS Implementation Mistake: How European Shippers Can Calculate True Total Cost of Ownership and Avoid Hidden Carrier Connectivity Costs in 2025

That German automotive parts manufacturer went from confident deployment to €800,000 mistake in six months. A mid-sized German automotive parts manufacturer discovered the hard way what happens when TMS hidden costs aren't properly budgeted. Six months into implementation, €800,000 spent, they realized their new system couldn't handle their complex carrier network across 12 countries. Sound familiar?

You're not alone. Hidden costs in TMS procurement consistently add 25-30% more than initial estimates, turning what looked like smart investments into budget disasters. While procurement teams focus on feature checklists and license fees, the real financial impact lives in implementation complexity, carrier integration charges, and ongoing maintenance expenses that vendors rarely discuss upfront.

European shippers face unique challenges that make cost calculations particularly complex. Most European shippers work with 20-30 regular carriers but could benefit from access to 200-300 qualified providers. Your 12-country carrier networks, multi-modal requirements, and regulatory compliance demands create cost pressures that basic TMS comparisons miss entirely.

The European TMS Cost Crisis: Why 70% of Implementations Exceed Budget

The numbers don't lie. 76% of logistics transformations fail to achieve their performance objectives. European procurement teams are discovering a harsh reality: their TMS budget calculations are missing over half the true costs.

TMS implementation costs range from €30,000 to €900,000, depending on complexity and vendor approach. But here's what catches European shippers off-guard: recurring costs spread over 10+ years typically link directly to shipment volumes, while one-time implementation expenses hit immediately.

The 2025 vendor consolidation landscape adds another layer of complexity. The most significant TMS vendor consolidation wave in over a decade is reshaping European procurement decisions right now. WiseTech's acquisition of E2open in 2025, Descartes' purchase of 3GTMS for $115 million in March 2025, and Körber's transformation of MercuryGate into Infios following their 2024 acquisition represent just the beginning of a fundamental market restructuring.

Traditional RFP processes that worked when you had 15-20 stable vendor choices now fail in an environment where the European TMS market, valued at €1.4 billion in 2024 and growing at a compound annual growth rate of 12.2 percent, is forecasted to reach €2.5 billion by 2029. This growth is happening alongside unprecedented consolidation that's eliminating choice and creating new risks for procurement teams.

The 7 Hidden Cost Categories Your Vendor Won't Discuss

License fees represent just the starting point. Consider these TCO components: base licensing (20-30% of total), implementation services (25-40%), carrier integration (15-25%), customization and training (10-20%), and ongoing support (15-20%).

Carrier connectivity represents one of the largest hidden cost areas. Some TMS providers offer published APIs for carrier integration, but carriers may charge shippers for establishing these connections.

Cross-border regulatory compliance costs hit European shippers particularly hard. Your TMS must handle GDPR compliance, data localization requirements, and cross-border data transfer restrictions. Cloud providers meeting these requirements often charge premium rates for European data centers.

Data migration and system integration expenses multiply with complexity. Basic API integrations cost €5,000-€15,000, while complex ERP connections exceed €50,000. A basic domestic shipper requires 10-15 integrations minimum, potentially totaling 1,000-1,500 hours of labor.

Training and change management costs escalate when you realize modern implementations require process redesign, not just software deployment. Implementation speed matters for ROI timing. Cloud-native solutions like Cargoson report 6-12 weeks to value, while enterprise platforms like Blue Yonder might require 6-12 months.

Ongoing maintenance and support charges accumulate over time. Business requirement changes generate ongoing costs that initial contracts rarely address adequately. Custom code development, workflow modifications, and integration updates accumulate over the system lifecycle.

Currency and multi-country operational overhead adds complexity that single-market vendors underestimate. Consider how your chosen platform handles rate conversions, tax calculations across 27 EU member states, and local carrier documentation requirements.

Carrier Connectivity: The Biggest Budget Killer

Here's the reality check: many carriers aren't willing or able to create API connections, and even when they are, they'll charge integration costs to you. European shippers working with 20-30 regular carriers face substantial connectivity expenses that vendors rarely discuss during initial demos.

The math becomes problematic quickly. While carriers can easily join platforms through portals, requesting completely new carrier API/EDI integrations is complex and costly - many providers don't build custom integrations themselves but provide standard EDI interfaces that carriers must implement.

Consider the contrast between different approaches. Compare carrier networks: Alpega connects to 80,000+ European transport professionals, MercuryGate offers broad North American coverage, and Cargoson focuses on European API/EDI connections. But network size doesn't tell the full story.

Cargoson builds true API/EDI connections with carriers, not just accounts in software or standardized EDI messages that carriers must implement themselves. This difference affects both implementation speed and long-term maintenance costs.

Pre-built network value versus custom integration expenses creates significant TCO differences. Cargoson includes carrier connections in their standard pricing, while enterprise platforms often charge separately for each integration. Direct API/EDI connections to 1,500+ carriers globally, with strongest coverage in Europe. New carrier integrations added free on request with no setup or additional monthly fees.

API versus EDI cost differences matter for long-term budgeting. API implementation can be less costly than EDI because it doesn't require ongoing maintenance or translation services and is an excellent method to differentiate as a partner and service provider. Yet many European carriers still rely on EDI, requiring hybrid approaches that complicate cost calculations.

Building a Bulletproof TCO Calculation Framework

The 5-year TCO framework requires calculating license fees, implementation services, carrier connectivity, customization, training, and support. But European shippers need a more detailed methodology that accounts for regional complexities.

Start with volume projections across different shipment types. Per-shipment models show significant cost variations: 1,000-10,000 shipments: €2.50-€4.00 per transaction · 10,000-100,000 shipments: €1.00-€2.50 per transaction · 100,000+ shipments: €0.25-€1.00 per transaction

Compare this to licensed models where licensed TMS software runs $50,000-$400,000+ with annual maintenance charges ranging from 15-20% of license costs.

RFP questions that expose hidden costs require specificity. Ask: "What would our actual monthly invoice look like in month 6, 12, and 24 based on our volume projections?" The most telling question: "What would our actual monthly invoice look like in month 6, 12, and 24 based on our volume projections?" Vendors confident in their pricing transparency will provide detailed breakdowns.

Benchmark implementation timelines realistically. Successful implementations from Transporeon, Oracle TM, and Alpega share common traits: conservative ROI projections, comprehensive cost accounting, and realistic timelines. Factor migration complexity, training requirements, and process redesign time into your calculations.

Compare platforms using a structured matrix including established players like Alpega, Manhattan Active, and SAP TM alongside European-focused solutions. Create a vendor comparison matrix including established players like Alpega, E2open, and Manhattan Active alongside emerging solutions like Cargoson. Include separate columns for transaction costs, integration fees, eFTI readiness, and total 5-year TCO projections.

The 2025 Vendor Consolidation Impact on Procurement Strategy

The acquisition wave reshaping the TMS landscape directly affects your procurement calculations. Descartes Systems Group bought 3GTMS for USD 115 million in March 2025 and Sellercloud in October 2024, adding domestic planning and omnichannel order-management modules that round out end-to-end visibility. Meanwhile, WiseTech's strategic acquisition of E2open combines two of the most acquisitive players in this space.

Product roadmap uncertainties are already surfacing. When two TMS platforms merge, customers inevitably face decisions about which system to standardize on, what features will be deprecated, and how long dual support will continue.

Support structure changes follow quickly. Support structure changes follow quickly. The European mid-market manufacturers who relied on direct access to MercuryGate's development team now navigate Körber's broader supply chain portfolio, which has the potential to evolve into a more comprehensive solution but currently stands with limited international reach and basic reporting tools.

Risk mitigation strategies require identifying stable alternatives. The post-consolidation landscape reveals three distinct categories: global mega-vendors (Infios/MercuryGate, Descartes, SAP TM, Oracle TM, E2open/WiseTech), European specialists (Alpega, nShift, Transporeon/Trimble), and emerging European-native solutions (including Cargoson) that focus specifically on cross-border European operations.

API-first architecture requirements become more important when vendor stability questions arise. Look for platforms that provide API access to your data and don't create vendor lock-in through proprietary integration formats.

Multi-vendor strategies might seem appealing but create additional complexity. Consider how different TMS platforms will share data, handle carrier relationships, and coordinate shipment execution across your European operations.

Regional Cost Considerations for European Operations

Multi-country carrier network complexity drives costs that North American-focused platforms struggle to handle efficiently. European operations require understanding of different carrier documentation standards, customs requirements, and local regulations across 27 EU member states plus UK, Norway, and Switzerland.

Regulatory compliance costs accelerate in 2025. Now they're facing a complete re-implementation as several EU Member States · The EU ETS shipping costs for 2025 will hit European shippers harder than most expected, with coverage jumping to 70% of emissions from just 40% in 2024. Carriers warn their ETS surcharges could nearly double under the updated regulations.

Currency handling and cross-border operational fees add ongoing costs. Your TMS needs to handle rate comparisons across different currencies while accounting for currency fluctuation risks. Some platforms charge additional fees for multi-currency support.

Local versus global provider cost structures create different value propositions. European-focused providers like Alpega, nShift, and Transporeon understand regional requirements but may lack global reach. While carriers can easily join the platform through their portal, requesting completely new carrier API/EDI integrations is more complex and costly. Alpega typically doesn't build custom carrier integrations themselves but acquires companies with existing connections or provides standard EDI interfaces that carriers must implement.

Compare this to platforms like Cargoson that focus specifically on European shippers: Cargoson was designed as a hybrid between a transport management system (TMS) and a multi-carrier shipping software. Built specifically for European manufacturers, wholesalers and retailers (and not for carriers), it handles everything from small parcels to full truckloads, air and sea freight with complete carrier neutrality.

Your 2025 Action Plan: Avoiding the €800K Mistake

Immediate steps for ongoing procurement projects start with demanding detailed cost breakdowns that extend beyond license fees. Watch for these warning signs during procurement: reluctance to provide detailed cost breakdowns, vague implementation timelines, limited references in your industry vertical, and unclear change request processes.

Red flags include vendors who deflect pricing transparency questions or provide only theoretical savings calculations. Others will deflect or provide vague estimates. Your next step: build that TCO model now, before the eFTI deadline creates time pressure that compromises your negotiating position. The vendors with genuinely transparent pricing will welcome the scrutiny.

Budget planning requires conservative assumptions about implementation complexity. Factor 25-30% contingency for hidden costs, but also understand where those costs typically occur. Integration complexity, training requirements, and process redesign usually drive overruns.

Timeline expectations should account for European-specific requirements. Cloud-native solutions built for European operations typically deploy faster than enterprise platforms requiring extensive customization for regional compliance.

When to consider alternatives becomes clear when vendors can't provide transparent pricing or realistic implementation schedules. Managed transportation services might make sense for certain lanes, but don't solve the underlying need for TMS capabilities across your full network.

The window for advantageous negotiations closes as vendor consolidation accelerates. Current market conditions favor shippers who move quickly with well-defined requirements and realistic budgets. Document your carrier network requirements, volume projections, and integration needs before starting vendor conversations.

Start your evaluation with platforms that understand European operations intrinsically rather than trying to adapt North American solutions. The German automotive manufacturer's €800,000 lesson demonstrates the cost of this mistake.

Focus on total cost of ownership over the licensing fee headlines. A €50,000 annual license that requires €200,000 in integration costs creates worse ROI than a €100,000 solution with comprehensive carrier connectivity included.