Multi-Carrier API Integration for TMS: The Complete Selection and Implementation Guide for European Shippers in 2025

Your European manufacturing company faces a complex choice: how do you connect with 50+ carriers across air, sea, and road freight without drowning in API maintenance? Multi-carrier APIs allow you to compare shipping rates from multiple carriers in real time, but the technical architecture decision you make today will determine whether your TMS investment drives efficiency or creates operational headaches for years to come.

The value of the European TMS market reached around € 1.2 billion in 2023. Growing at a compound annual growth rate (CAGR) of 12.1 percent, the market value of transport management systems in Europe is forecasted to reach € 2.1 billion in 2028. This growth reflects companies recognizing that manual carrier management doesn't scale, yet many still struggle with the fundamental question: build direct integrations, use a unified API platform, or invest in TMS-native carrier connectivity?

The Multi-Carrier API Integration Challenge: Why Legacy Approaches Fail

European manufacturers typically work with 15-25 carriers across different transport modes. Your engineers will need to dedicate time toward studying a vendor's API documentation; they'll need to implement each integration via custom code; and they'll need to test their integrations to ensure they work as intended. While this process might seem feasible for a few integrations, it can quickly overwhelm your engineers if they face dozens of integration requests.

The maintenance burden compounds over time. There are also a variety of potential maintenance issues you might not anticipate and that burden your team even further. Integration challenges are often associated with the challenges of building integrations; in reality, maintaining integrations require just as much, if not more, time and effort from your team, as the work involved lasts as long as the integrations' lifespans.

Your IT teams discover that it can lead to scalability issues due to limitations in APIs and cause a burden on the maintenance teams to leverage constant effort to run shipping operations. Each carrier's API changes quarterly, authentication methods evolve, and new compliance requirements emerge across European markets. What started as a manageable integration project becomes a full-time maintenance operation.

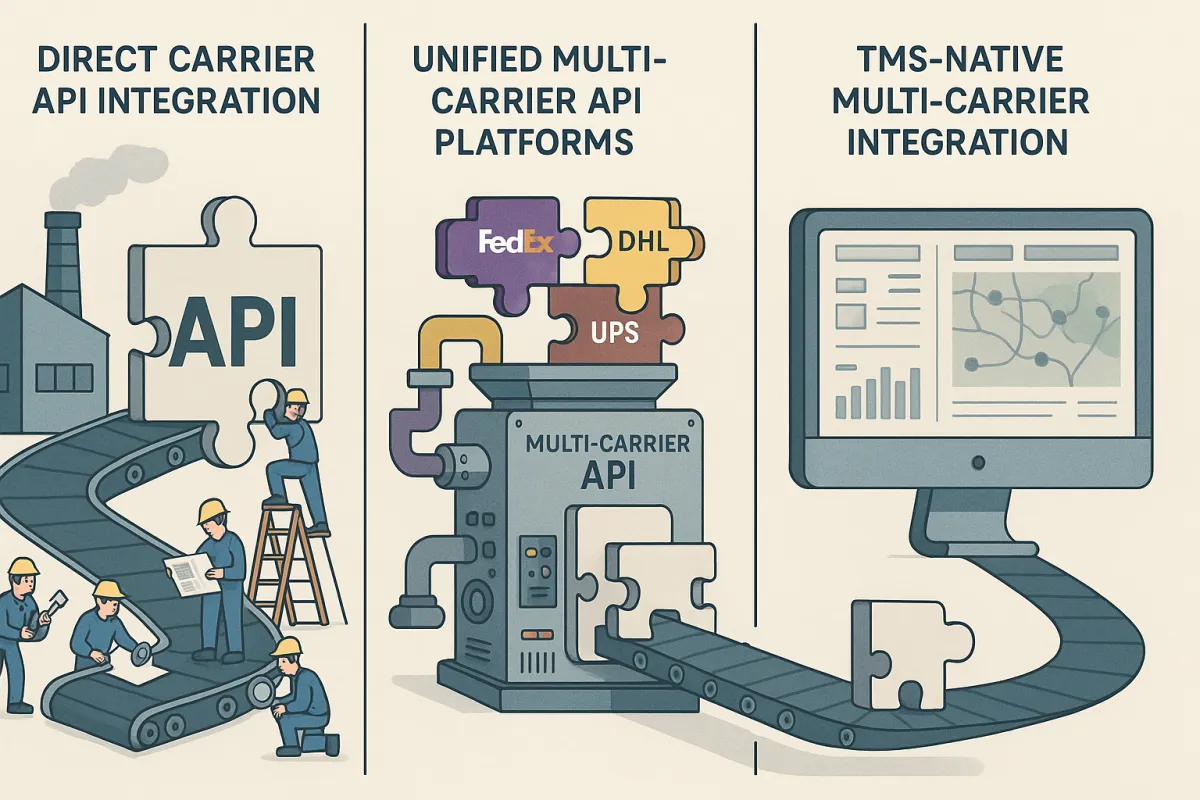

Multi-Carrier API Architecture Models: Three Strategic Approaches

European TMS deployments typically follow one of three architectural patterns, each with distinct technical and operational implications.

Direct Carrier API Integration: When Control Matters Most

Direct integration makes sense when you have significant volume with specific carriers or unique operational requirements. Large automotive manufacturers often take this approach with primary logistics partners, building dedicated integrations for DHL, Schenker, or Kuehne + Nagel.

However, it can lead to scalability issues due to limitations in APIs and cause a burden on the maintenance teams to leverage constant effort to run shipping operations. You gain maximum control over data flow and can optimize for specific business logic, but you also inherit all maintenance responsibilities.

The development timeline alone presents challenges. Usually, the process can take up to 24 hours but in many cases, it may take more time. More time can disrupt regular shipping operations and businesses can experience a competitive disadvantage. This assumes straightforward implementations - complex requirements or carrier-specific customizations extend timelines significantly.

Unified Multi-Carrier API Platforms: Centralized Complexity Management

Unified platforms like ShipEngine, EasyPost, and Shippo abstract carrier complexity behind standardized interfaces. Instead of maintaining separate integrations for each carrier, including FedEx, UPS, DHL, USPS, a Multi-Carrier Shipping API consolidates them into one interface. Benefit: Simplifies carrier onboarding and reduces technical complexity; Result: Faster integration with new carriers and easier management of shipping operations.

These platforms handle the maintenance burden that overwhelms internal teams. As you build and maintain API integrations, you'll likely come across several obstacles. There are the more well-known challenges associated with building integrations, but there are also a variety of potential maintenance issues you might not anticipate. Unified platforms absorb this complexity, providing consistent interfaces regardless of underlying carrier API changes.

The trade-off comes in rate markups and feature limitations. You pay for the abstraction layer through per-transaction fees or percentage markups on shipping costs. Additionally, you're constrained by the platform's carrier coverage and feature set - if they don't support a specific regional carrier or specialized service, you're back to custom development.

TMS-Native Multi-Carrier Integration: The Enterprise Approach

Modern TMS platforms like Cargoson, nShift, and Alpega build carrier connectivity directly into their transport management functionality. Builds true API/EDI connections with carriers, not just accounts in software or standardized EDI messages that carriers must implement themselves.

This approach provides deeper integration between transport planning and carrier execution. Rate comparison happens within shipment planning workflows, tracking updates integrate with transportation visibility, and carrier performance data feeds directly into procurement decisions.

The European advantage becomes clear with platforms designed specifically for regional requirements. Some well-known companies that use it include Dachser, Schenker, Kuehne + Nagel, Hellmann Worldwide Logistics, GLS, Hermes, Gebrüder Weiss, etc. TMS-native solutions often include these European carriers by default, along with necessary compliance features for cross-border operations.

Critical Technical Evaluation Criteria for European Shippers

European multi-carrier API selection requires evaluating factors that don't apply to US-focused platforms. Data residency requirements, GDPR compliance, and specific carrier coverage create technical constraints that affect architectural decisions.

European Carrier Coverage Assessment

Breadth versus depth trade-offs appear immediately when evaluating carrier networks. Global platforms offer hundreds of carriers but may lack deep integrations with European regionals like GLS, Hermes, or DPD. Regional TMS providers often have stronger connections with local carriers but limited global reach.

Cross-border complexity multiplies integration challenges. The biggest downside is that it's a file exchange-based connection, which means that you would have to generate an actual, physical file, then transmit it over FTP and literally hope that all is okay because there is very cumbersome feedback about errors and warnings. Similar to EDIFACT is FORTRAS, a file-based connection with the same shortcomings. Many European carriers still rely on EDIFACT or proprietary file formats, creating integration complexity that unified API platforms struggle to abstract effectively.

Data Security and Compliance Requirements

Handling sensitive customer data comes with potential security risks requiring industry-standard encryption protocols. Make sure your API provider follows industry-standard encryption protocols and complies with relevant data protection regulations.

GDPR compliance affects every aspect of multi-carrier integration. Customer addresses, contact information, and shipment details must be processed according to European privacy regulations. Some unified API providers store data on US servers, creating compliance complications for European shippers.

Data residency requirements vary by country and industry. German manufacturers often require data processing within EU borders, while UK companies post-Brexit face additional complexity with data transfer agreements. Your API architecture choice determines whether you can meet these requirements without expensive custom configurations.

Implementation Strategy: Managing Technical Risk

Multi-carrier API implementations fail when companies underestimate the testing and validation requirements. I've seen this cycle repeat across multiple projects: integrations work perfectly during testing, but the moment they hit production, reality sets in — intermittent network issues, expired tokens, partial payloads, and missing responses. And every time something failed, someone on the team had to log in, dig through the syslog, reconstruct the payload, and re-send it manually.

Testing and Validation Framework

Pre-production testing requires more than basic rate queries and label generation. You need to validate edge cases: oversized packages, hazardous materials, restricted destinations, and carrier-specific service constraints. A sandbox environment offers you the chance to test an API integration's performance in a variety of ways. You can, for example, test your authentication and authorization protocols to ensure that the integration is secure; and you can test specific endpoints.

Rate accuracy testing becomes particularly complex with European carriers. Currency conversion, VAT handling, and country-specific surcharges create variations that sandbox environments may not accurately reflect. Plan for extended testing periods with real carrier data before full deployment.

Change Management and Team Training

API-driven workflows require operational changes that extend beyond IT teams. Your procurement teams need to understand rate comparison limitations, warehouse staff must adapt to new label formats, and customer service requires tracking system knowledge across multiple carriers.

Documentation requirements expand significantly with multi-carrier systems. Each carrier has different service levels, delivery constraints, and tracking capabilities. Your teams need clear guidance on when to use which carriers and how to handle exceptions when primary carriers fail.

Performance Monitoring and Maintenance Strategy

Poor API management introduces vulnerabilities, operational inefficiencies, and compliance risks into the ecosystem. According to Salt Security, 77% of cybersecurity incidents in 2024 involved APIs. Multi-carrier environments amplify these risks by increasing the number of external endpoints and authentication points.

Monitoring requirements differ based on your chosen architecture. Direct integrations require endpoint-specific monitoring for each carrier, while unified platforms need provider-level SLA tracking. TMS-native solutions often include integrated monitoring but may lack granular visibility into individual carrier performance.

Circuit breaker implementations become essential for production stability. That's when we introduced the Health Check Job — a circuit breaker. It pings each configured integration endpoint regularly. If the target system is down, it marks all pending retries as Skipped and temporarily halts retry attempts. When the system comes back online, those skipped calls are reactivated automatically.

Cost Analysis Framework: Understanding True TCO

Multi-carrier API costs extend far beyond monthly subscription fees or per-transaction charges. Development time, maintenance overhead, and operational complexity create hidden expenses that affect ROI calculations.

Development costs vary dramatically by approach. Direct integrations require 3-6 months per major carrier for initial implementation, plus ongoing maintenance resources. Unified platforms reduce initial development to weeks but introduce ongoing rate markups. TMS-native solutions typically require the least custom development but may involve higher platform licensing costs.

Maintenance overhead represents the largest hidden cost. Another key challenge for API integration is keeping up with ongoing maintenance needs. Once your business establishes a connection between two applications, the work is not done there — an IT or API professional should look at the integration from time to time and address any maintenance or upgrades required for continued operation. Businesses must understand that their integrations will need continuous updating, especially when adding new connections. A small functional change can create a domino effect and impact the rest of your company's processes.

ROI Calculation Model for European Mid-Market

Calculate break-even points based on shipment volumes, carrier diversity requirements, and internal development costs. Companies shipping fewer than 10,000 packages annually across 3-5 carriers typically benefit from unified platforms. Higher volumes or specialized requirements often justify TMS-native solutions or selective direct integrations.

Consider operational savings beyond development costs. Improved rate shopping can reduce shipping costs by 8-15%, while automated carrier selection and tracking reduce administrative overhead. Factor these savings into your ROI analysis alongside implementation and maintenance costs.

European mid-market companies often find that TMS-native approaches like Cargoson provide the best balance of functionality, European carrier coverage, and total cost of ownership. The integrated approach eliminates the complexity of managing separate systems while providing the carrier connectivity needed for effective multi-carrier operations.

Your multi-carrier API integration strategy should align with your operational complexity, technical resources, and growth plans. Simple operations benefit from unified platforms, complex enterprises require TMS-native solutions, and specialized requirements may justify direct integrations. The key is understanding your true requirements and total cost of ownership before making architectural decisions that will define your logistics technology stack for years to come.