Microservices TMS Architecture: How European Shippers Can Build Vendor-Independent Transport Management Systems and Cut Integration Costs 40% in 2026

European transport managers who assumed they had three more years to evaluate TMS options just ran out of time. WiseTech Global's $2.1 billion acquisition of E2open closed in August 2025, while Descartes Systems Group acquired 3GTMS for $115 million in March. The deal marks Descartes' 32nd acquisition since 2016, and these mega-transactions represent just the beginning of a vendor consolidation wave that's eliminating independent TMS options across Europe.

The crisis deepens with budget overruns hitting 75% of European TMS implementations, while hidden costs consistently add 25-30% more than initial estimates. A microservices-based TMS architecture offers European manufacturers and wholesalers a strategic escape route from vendor lock-in risks, enabling modular transport management systems that adapt to changing requirements without massive re-implementation costs.

The European TMS Vendor Consolidation Crisis: Why Architecture Matters More Than Features

The WiseTech-E2open acquisition is expected to be completed in 1H26, creating a supply chain software giant that controls logistics execution for thousands of European shippers. Meanwhile, 3GTMS brings complementary domestic transportation management functionality for truckload, less-than-truckload, and parcel modes to Descartes, expanding their carrier network in North America including API-integrated LTL carriers.

The financial scale tells the real story. Enterprise value of $2.1 billion comprises $1.2 billion of cash consideration to E2open shareholders, gross debt of $1.1 billion and $0.2 billion in cash. These aren't technology acquisitions - they're market control plays that create immediate procurement challenges for European shippers.

Consider the pattern: A German automotive parts manufacturer discovered their €800,000 TMS miscalculation the hard way. Six months into a North American platform deployment, they found their European carriers couldn't integrate without costly custom development. Their story reflects what happens when procurement teams focus on feature checklists while ignoring architectural flexibility.

Hidden Cost Reality: How Monolithic TMS Platforms Trap European Shippers

Implementation costs range from €30,000 to €900,000, and for shippers with freight spend exceeding $250M annually, implementation can cost 2-3 times the subscription fee. Basic European shippers typically need 10-15 carrier integrations, but complex operations require 140+ integration objects across multiple transport modes and regulatory requirements.

The "long pole of the tent" of implementation time, and therefore cost, resides in the design, build, and testing of integrations. Many carriers aren't willing or able to create API connections, and even when they are, they'll charge integration costs to you. European shippers working with 20-30 regular carriers face substantial connectivity expenses that vendors rarely discuss during initial demos.

The maintenance burden multiplies over time. Licensed TMS models include annual maintenance charges ranging from 15-20% of license costs, while carrier API changes require constant updates that drain internal resources or generate consulting fees.

Microservices Architecture Fundamentals for Transport Management

Traditional TMS platforms use monolithic architectures - single, large codebases where changing one function risks affecting the entire system. Enterprise applications, particularly those that have grown in size and complexity over the years (which includes transportation management systems), have migrated from a "monolithic" architecture to a "microservices" one.

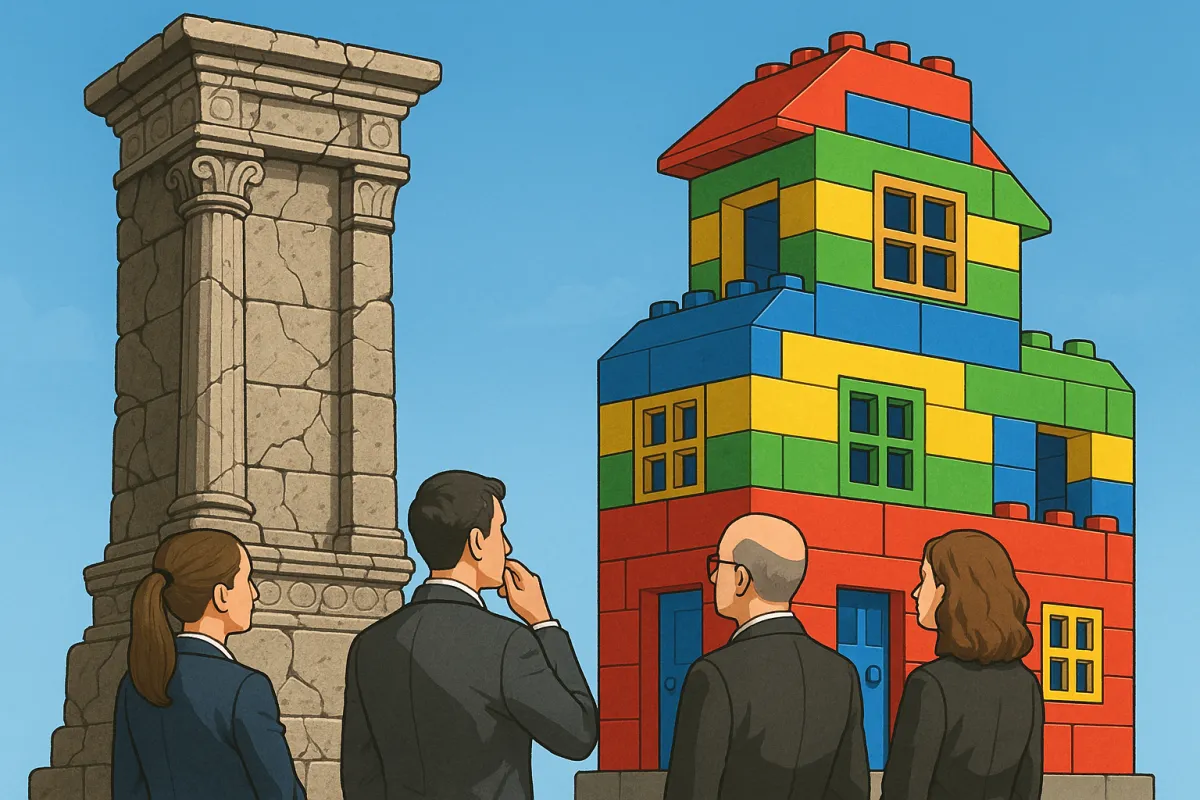

The best TMS software, such as Manhattan Active® Transportation Management System, is built with 100% microservices and is cloud native, which enables the software to be agile, extended, and can take advantage of seamless upgrades. Think of microservices TMS architecture as building with Lego bricks instead of carving from stone.

Instead of being one big piece of software code, think of a TMS that is built using the software equivalent of Lego bricks. Each brick (microservice) is designed to perform a different TMS function, like rating or tendering. You can add new bricks, remove outdated ones, and connect them together in different ways to enable specific workflows.

Manhattan Active TMS was described as "a cloud-native solution that is the industry's first self-configuring and self-tuning system and a quantum leap forward in optimization speed, with up to 80% faster solve times." This was not an upgrade to its previous TMS solution. It was a completely new solution, built from the ground up using the microservices architecture.

API-First Integration Strategy: Breaking Free from Vendor Dependencies

A microservices architecture offers a variety of benefits related to scalability and how new functionality is added and updated. The latter includes the ability for users to create their own unique functionality to extend the capabilities of the application - that is, it enables users to customize a cloud application to meet their unique needs without affecting the rest of the codebase.

Self-developed and third-party extensions are effectively "Lego bricks" that plug into the microservices framework of the application via APIs. This architectural approach prevents the vendor lock-in scenarios that plague European shippers during consolidation cycles.

European shippers need solutions from multiple vendors: Cargoson for cross-border European operations, nShift for carrier connectivity, and specialized providers for customs documentation. Microservices TMS platforms enable these integrations without requiring expensive middleware or custom development.

Cost Analysis: Microservices vs Monolithic TMS Implementation

The total cost comparison reveals striking differences. Transaction-based TMS pricing ranges from €0.25 to €4.00 per shipment, but the final figure depends on factors most vendors conveniently omit from their sales presentations. Traditional monolithic implementations face actual costs exceeding initial projections by 25-30%.

Microservices architecture delivers measurable economic advantages. Better carrier selection, mode optimization, consolidation, and fewer expedites can reduce total freight costs by 5% to 15% in many environments. Automating load building, tendering, scheduling, and billing can reduce admin effort by 20% to 40%, especially if your current process lives in email and spreadsheets.

A European manufacturer with €2M annual transport spend invests €200K in a TMS implementation. The annual gains break down to: €85K in fuel savings through route optimization, €120K in productivity gains from automated planning, €25K in dispute reduction through improved documentation. Total annual benefit: €280K.

European Compliance Advantages: eFTI and CBAM Readiness

Regulatory compliance demands create additional architecture requirements. As of 9 July 2027: The eFTI Regulation will apply in full. Member State authorities must accept information shared electronically by operators via certified eFTI platforms. It could save the EU transport and logistics sector up to €1 billion per year.

Microservices TMS platforms adapt to compliance changes through modular updates. The regulation mandates that authorities in all EU Member States will be required to accept electronic data when shared by businesses via eFTI-compliant platforms. Legacy monolithic systems require extensive redevelopment for each regulatory change.

Your TMS selection directly impacts eFTI readiness. Business data must be housed on secure, certified IT platforms that integrate with existing data management systems. Not every TMS vendor offers native eFTI functionality. Microservices architecture enables rapid integration with certified eFTI platforms through standardized APIs.

Implementation Roadmap: Building Microservices-Ready TMS Strategy

European shippers can transition to microservices TMS architecture through a structured approach that minimizes disruption while maximizing vendor independence. Start with honest assessment of your current transport processes and carrier relationships.

Phase 1: Architecture Assessment (Q1 2026)

Document your integration requirements across all transport modes. Phase 1: Assessment and Planning (4-6 weeks) Document your current transport processes, carrier relationships, and integration requirements. Many companies discover they need fewer integrations than originally assumed when they map actual workflows.

Phase 2: Vendor Evaluation with Microservices Criteria

Evaluate TMS platforms based on architectural flexibility, not just feature lists. Include Cargoson, Manhattan Active TM, and emerging European-focused solutions alongside traditional enterprise vendors. Cloud-native solutions like Cargoson focus on reducing implementation complexity through pre-built integrations and European carrier connectivity.

Phase 3: Contract Protection Against Consolidation Risk

Avoid contract terms that exclude vendor responsibility for regulatory compliance updates. Any TMS contract signed now should include eFTI and Smart Tachograph compliance as baseline requirements, not optional upgrades. Include acquisition protection clauses that guarantee service continuity and prevent price increases following vendor changes.

European manufacturers and wholesalers face an architectural decision that will define their transport management capabilities for the next decade. The competitive landscape will favor early adopters. Companies implementing eFTI-compatible systems now gain operational advantages while competitors struggle with compliance deadlines.

Microservices-based TMS architecture offers the vendor independence and implementation flexibility that European shippers need to thrive in this consolidating market. The July 2027 eFTI deadline creates urgency, but the real advantage belongs to organizations that build modular transport management capabilities today, before vendor consolidation eliminates their options entirely.