eFTI-Compliant TMS Selection Guide 2025: How European Shippers Can Avoid €800,000 Implementation Mistakes While Ensuring 2027 Regulatory Compliance

A German manufacturer learned what a €800,000 TMS failure looks like when they discovered six months into implementation that their primary carriers couldn't integrate without costly custom development. This wasn't isolated bad luck. According to the Standish Group's Annual CHAOS 2020 report, 66% of technology projects end in partial or total failure, and 17% of large IT projects go so badly, they threaten the very existence of the company.

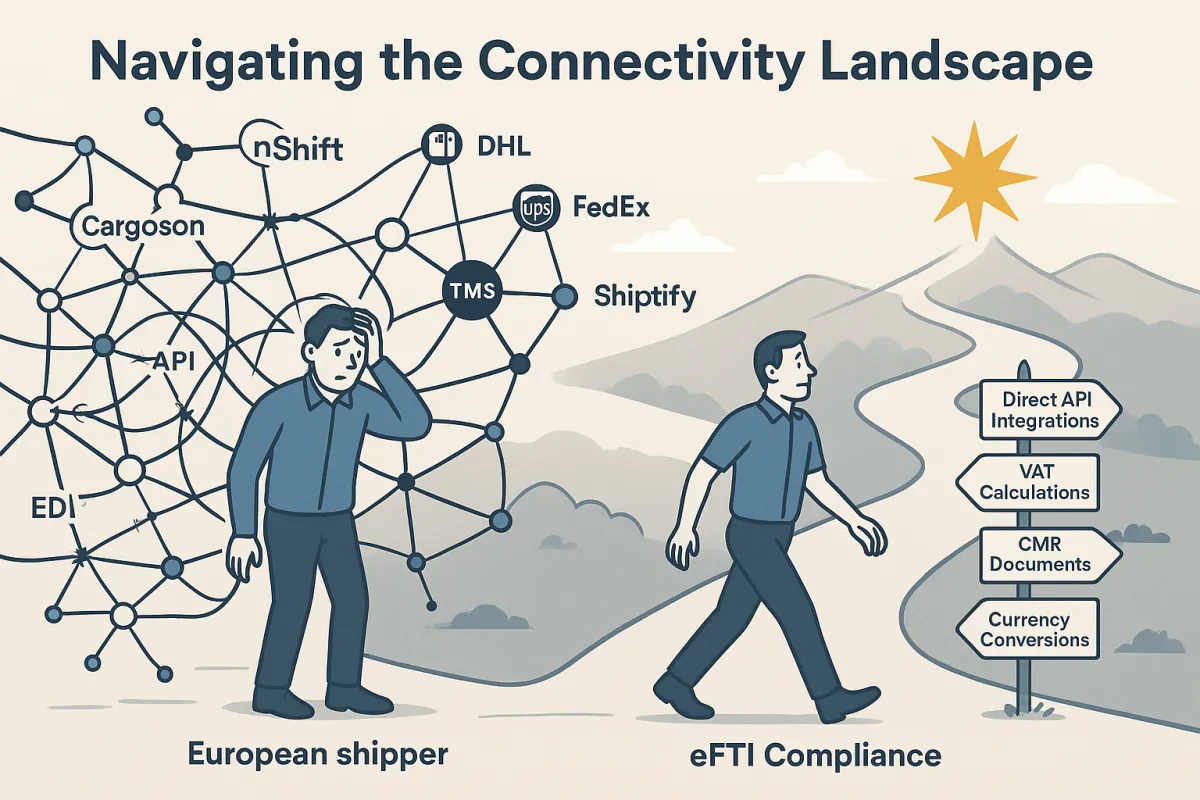

The mistake? Choosing a North American-focused platform for European operations without understanding the fundamental differences in carrier networks and integration requirements. European shippers work with everything from large multinational logistics companies to regional specialists who still fax rate sheets. Your TMS needs to handle this complexity, not break under it.

These failures aren't random. Many carriers aren't willing or able to create API connections, and even when they are, they'll charge integration costs to you. European shippers working with 20-30 regular carriers face substantial connectivity expenses that vendors rarely discuss during initial demos.

Understanding eFTI Regulation Requirements for Your TMS (2027 Deadline)

The regulatory landscape makes TMS selection even more critical. As of 9 July 2027, the eFTI Regulation will apply in full, requiring Member State authorities must accept information shared electronically by operators via certified eFTI platforms.

Your TMS must be ready, or you'll face compliance gaps that could shut down cross-border operations. The regulation affects road, rail, inland waterway, and air transport, meaning every mode in your network needs preparation.

Here's the timeline that matters: September 2025: The European Commission will adopt additional technical specifications for eFTI platforms, service providers, and certification rules. January 2026: Certified eFTI platforms and service providers may begin operations. Authorities will start accepting electronic data from these platforms.

Critical Technical Capabilities Your TMS Must Have

QR code generation and machine-readable format requirements become mandatory by July 2027. Your TMS must generate these automatically for every shipment across all transport modes.

The system must also provide unique access links in machine-readable formats such as QR codes and ensure business data will be housed on secure, certified IT platforms that can be easily integrated with companies' existing data management systems.

Integration with eFTI-certified platforms isn't optional. From July 2027, secure eFTI-certified IT platforms will allow companies to share transport information electronically with authorities and business partners, integrating these platforms into existing data systems.

European-Specific TMS Evaluation Criteria That Matter

Generic TMS evaluation criteria miss what makes European operations different. You need a system that handles Your German carrier database might list "Deutschland" while your French system uses "Allemagne" for the same country. Multi-currency support isn't just nice to have when you're dealing with EUR, GBP, CHF, and SEK in a single week.

Ask these specific questions during evaluation: How many European carriers have direct API integrations versus standard EDI interfaces? Can the system handle VAT calculations across different EU member states? Does it generate CMR documents automatically for cross-border shipments? How does it manage currency conversions for real-time rate comparisons?

The answers reveal whether you're looking at a European-ready system or one that will require expensive customization. Cargoson offers direct API/EDI integrations with carriers across all transport modes, while Transporeon connects 150,000+ carriers but many integrations are standard EDIs or PDF/email transmissions rather than true API connections.

Look for platforms with pre-built integrations for European logistics providers like DHL, DB Schenker, DSV, and Kuehne+Nagel. These aren't just "supported" carriers - they're direct API connections that sync rates, booking, and tracking automatically.

Vendor Comparison Framework: Enterprise vs Mid-Market Solutions

Enterprise solutions like SAP TM and Oracle TM offer comprehensive functionality but typically cost $200,000-$1,000,000+ annually with significant implementation costs. They're built for companies with dedicated IT teams and complex approval workflows.

Mid-market European-focused alternatives like Cargoson, Descartes, and nShift target different needs. Cargoson is a modern European TMS that bridges the gap between complex enterprise systems and simple shipping tools. It offers direct API/EDI integrations with carriers across all transport modes (FTL, LTL, parcel, air, and sea freight).

nShift specializes in parcel/LTL shipping and e-commerce fulfillment, with particularly strong presence in Nordic countries, the UK, and Benelux regions. Carrier network: 1,000+ true carrier API/EDI connections, primarily focused on parcel carriers. However, adding new carrier API integrations can cost €5,000-€10,000 each and take months to implement.

Descartes brings global experience but Access to over 10,000 carrier connections via EDI and API, though many are through standard EDI formats that carriers must implement. Adding new carriers requires significant setup time and may involve additional costs.

Implementation timelines vary dramatically. Traditional TMS systems cost €100,000+ annually and take months to install. Cloud-based alternatives start at €199/month and get you shipping in weeks without buying servers or software.

Implementation Strategy: Avoiding the 40% Failure Rate

European TMS implementations don't have to join the 40% failure rate. The companies that succeed treat implementation as business transformation, not software deployment.

They succeeded because they treated the project as business transformation, not software implementation. They allocated budget for extensive change management, hired European transportation consultants who understood both the software and local market requirements.

Use a phased approach. The most successful migrations we've observed follow a phased approach: pilot with one major lane, measure results carefully, then expand systematically. Start with your highest-volume lane or simplest carrier relationships, then add complexity gradually.

An implementation for some start-ups can be completed in a month with more extensive start-ups taking 6 months. All-in, the average install is roughly two to three months tops for cloud solutions, versus traditional systems that can drag on much longer.

Budget appropriately. TMS implementation costs range from €30,000 to €900,000, depending on complexity and vendor approach. But here's what catches European shippers off-guard: recurring costs spread over 10+ years typically link directly to shipment volumes.

Carrier Integration Requirements for European Operations

European carrier connectivity is messier than vendors admit. You'll need integrations for API failures, data format differences, and the inevitable carrier who still only accepts EDI formats from 1995.

Modern cloud-based shipping software connects directly with hundreds of carriers through pre-built API and EDI integrations. Instead of setting up separate technical connections with each transport provider, you get access to your whole carrier network through one platform.

The difference between platforms becomes clear in the details. Some TMS providers like Cargoson will integrate any carrier for you, for free (while others charge you for that and make you wait months or years). Requesting a new carrier integration, in case we haven't built it yet, is free for all customers at Cargoson, versus significant fees elsewhere.

While carriers can easily join platforms through portals, requesting completely new carrier API/EDI integrations is complex and costly - many providers don't build custom integrations themselves but provide standard EDI interfaces that carriers must implement.

Look for providers that handle integration complexity for you. Cargoson integrates with carriers via API or EDI, as well as with those who operate through email - a tailormade approach. This flexibility matters when dealing with diverse European carrier networks.

2025-2027 Implementation Roadmap and Next Steps

Start your evaluation now. The eFTI deadline creates pressure, but companies implementing eFTI-compatible systems now gain operational advantages while competitors struggle with compliance deadlines.

Q1 2025: Assess current capabilities and document gaps. Which carriers have API connections? What manual processes slow you down? How do you handle cross-border documentation today?

Q2-Q3 2025: Evaluate solutions and begin selection. September 2025: The European Commission will adopt the remaining implementation specifications, detailing functional and technical requirements for eFTI platforms and service providers. Use these specifications to validate vendor compliance.

Q4 2025-Q2 2026: Implementation and testing. Member States authorities may start accepting data stored on certified eFTI platforms for inspection from January 2026. Use this voluntary period for real-world testing and staff training.

Create your budget based on realistic scenarios. Cloud-native solutions like Cargoson report 6-12 weeks to value, while enterprise platforms like Blue Yonder might require 6-12 months. Factor these timelines into your cash flow projections.

The stakes are high. The European Commission estimates eFTI could save the EU transport and logistics sector up to €1 billion per year. But only companies with compliant, well-integrated systems will capture those savings.

Your next steps: Document current freight processes and pain points. Request demos from solutions designed for European operations like Cargoson, nShift, and Descartes. Ask specific questions about eFTI compliance, carrier integration costs, and European regulatory support. The July 2027 deadline approaches faster than you think.