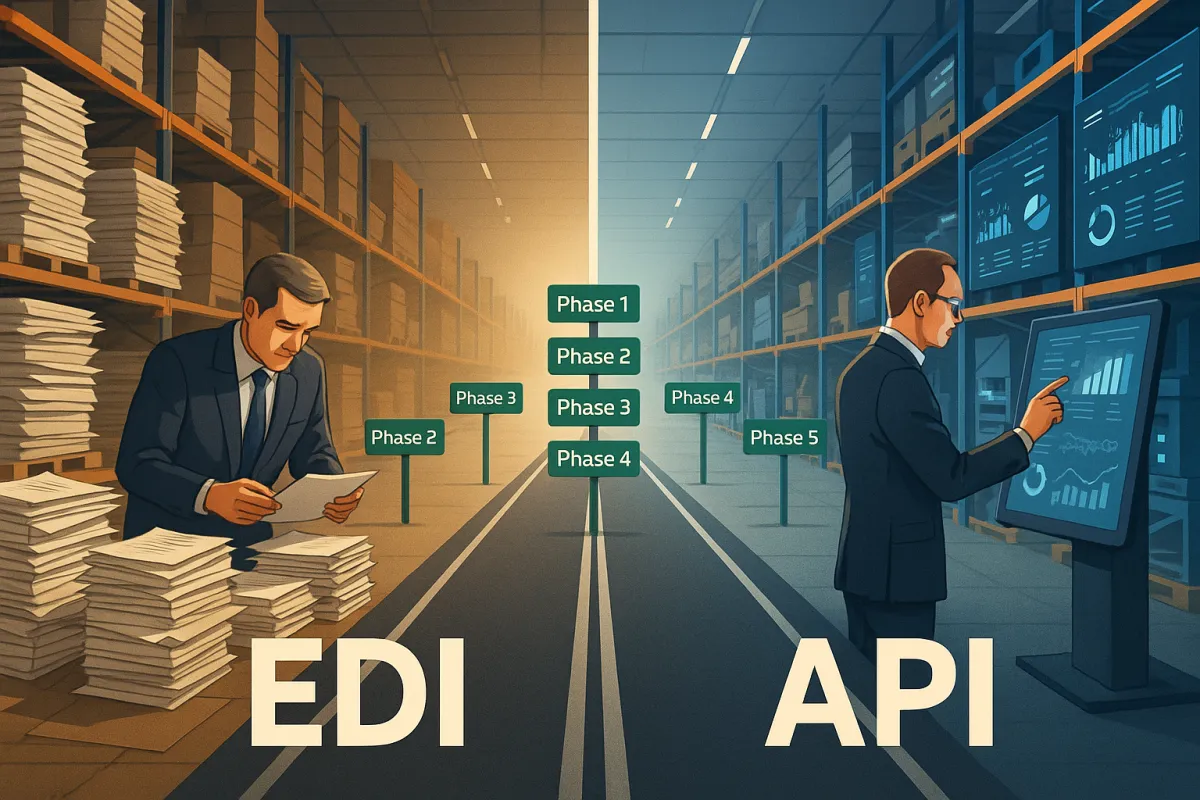

EDI to API Migration Roadmap: A 5-Phase Strategy for European Manufacturers to Modernize Carrier Connectivity Without Breaking Existing TMS Workflows

Your transport department is managing EDI connections with 50+ carriers, and procurement has just asked about migrating to "modern APIs" to get real-time tracking. The IT director warns about disrupting existing workflows that process 200,000 shipments annually. Sound familiar?

Despite predictions that APIs would replace EDI entirely, transportation and logistics segment was attributed to holding the largest market in 2025 for EDI usage. In 2021, IBM estimated that over 85% of large companies worldwide had used EDI in their supply chains. But in this report, IBM referred to Gartner, which predicted that API would be used in at least 50% of world supply chains. The reality? European manufacturers need both.

This comprehensive roadmap shows you how to implement a strategic hybrid EDI-to-API migration over 24 months without breaking your existing TMS workflows or requiring massive upfront investments.

The Reality of Carrier Connectivity in 2025 - Why Full EDI Replacement Isn't Realistic

Let's address the elephant in the room. Some businesses assume APIs are inherently faster and more flexible, leading to the misconception that APIs will eventually replace EDI. However, this overlooks a key factor: compliance. Many large retailers, distributors, and logistics providers still require EDI to maintain uniformity and consistency in their supply chain operations.

EDI lowers transaction costs by at least 35% compared to traditional paper-based methods, and EDI speeds up business cycles by 61% for established, high-volume transactions. The numbers don't lie - EDI isn't going anywhere.

Systems like MercuryGate, Descartes, and Cargoson have adapted by building hybrid approaches. Given these factors, it's less about EDI vs. API, and more about taking a "best of both worlds" approach, which sets you up for success. Rather than replace EDI, integrate it with APIs, other cloud platforms, and AI/ML, so you can enhance automation and flexibility within your digital ecosystem.

The Three Critical Barriers to Complete API Migration

Partner readiness remains the biggest challenge. Partner buy-in still tops the list when implementing API-based logistics integration. Your largest carrier might offer an API, but your regional LTL providers probably don't.

System limitations in current transport management software create the second barrier. As early as 2020, 83% of surveyed technology professionals stated that API integration is a "critical part of their business strategy." The supply chain industry has lagged in this aspect of digital transformation but is beginning to adopt an "API-first" development approach. With big box retailers continuing to use EDI systems for data exchange, the supply chain industry didn't have much impetus to rush the transition.

Compliance and audit requirements create the third barrier. European manufacturers handling hazardous materials or operating in regulated industries can't simply switch overnight. The documentation trail, security protocols, and data formats required for customs clearance often mandate EDI standards.

Phase 1 - Assessment and Strategic Planning (Months 1-2)

Before touching any integrations, you need a clear picture of what you're working with. Start by documenting every EDI connection, message type, and carrier relationship in your current setup.

Most European manufacturers discover they're using 15-20 different EDI message types across their carrier network. The most common include EDI 204 (Motor Carrier Load Tender), EDI 214 (Transportation Carrier Shipment Status Message), and EDI 210 (Motor Carrier Freight Details and Invoice). Focus your migration efforts on high-frequency, time-sensitive connections first.

Mapping Your Current EDI Landscape

Create a spreadsheet listing every carrier, the EDI messages you exchange, monthly transaction volumes, and current latency issues. Identify carriers who already offer APIs - many don't advertise them widely. DHL, FedEx, and major European carriers like DB Schenker have robust API offerings, but your regional carriers probably rely on EDI exclusively.

For each connection, calculate the business impact of delays. Real-time dock scheduling updates matter more than monthly invoice reconciliation. This analysis guides your priority list for Phase 2.

Run a cost-benefit analysis comparing current EDI VAN fees, mapping maintenance costs, and system complexity against potential API development investments. Adding new carrier integrations costs approximately $3,000 per carrier, with carriers typically implementing standard EDI/XML messages themselves in traditional setups.

Phase 2 - Pilot Implementation with Low-Risk Connections (Months 3-4)

Don't start with your most critical carrier relationships. Begin with dock scheduling and status updates - areas where real-time data provides immediate value without disrupting core transaction flows.

Systems like FreightPOP, Shiptify, and Cargoson excel at these pilot implementations. Mirror one high‑volume EDI message. Expose the 856 ASN (or your busiest doc) as a REST endpoint. Measure latency gains before scaling to more partners.

Selecting Your Beachhead Integration

Dock scheduling is a low‑risk beachhead for moving time‑critical data off 40‑year‑old EDI rails. Why dock scheduling works as a starting point: it's typically handled by separate systems from your core TMS, involves fewer compliance requirements, and provides immediate ROI through reduced waiting times.

Technical implementation starts with a simple REST endpoint that accepts appointment requests in JSON format and responds with confirmation or alternative time slots. Run this alongside your existing EDI 753 (Request for Routing Instructions) messages for the same carrier.

Track three key metrics during your pilot: API response time versus EDI batch processing delays, manual intervention requirements, and dock utilization improvements. Success means API calls process in under 2 seconds while EDI might take 15-30 minutes for the same information.

Phase 3 - Hybrid Gateway Implementation (Months 5-8)

Here's where the magic happens. Deploy middleware that accepts API calls from your internal systems and converts them to EDI for carriers that aren't ready to migrate. This approach gives you real-time speed internally without requiring every carrier to retool their systems.

Your gateway receives an API call for shipment booking, translates it to X12 or EDIFACT format, and sends it via traditional EDI channels. The carrier sees their familiar EDI 204 message, but your TMS gets immediate API confirmation.

Gateway Selection Criteria

European EDIFACT standards require different handling than US X12 formats. Look for gateways that understand both protocols and can handle the complexity of multi-country operations.

Cost models vary significantly. Competitors offer two flavors: cloud EDI hubs that lift your existing files unchanged, and hybrid gateways that accept an API on your side and translate it to X12/EDIFACT only for partners that still need one. Compare by pricing model (per‑kB vs. per‑call) and how easily each ties into your ERP or TMS.

Integration complexity matters. Platforms like Manhattan Active, Blue Yonder, and Cargoson offer pre-built connectors that reduce implementation time from months to weeks.

Phase 4 - Progressive Partner Migration (Months 9-18)

Now you can start migrating partners individually without disrupting operations. Your hybrid gateway gives you flexibility to move decision-critical data via API while keeping audit-critical records on EDI during transition periods.

Start with carriers who already offer APIs and handle significant volumes. Major European carriers like DB Schenker, DSV, and Kuehne+Nagel have invested heavily in API platforms. Smaller, regional carriers might need more time or choose to stay on EDI permanently.

Partner Onboarding Strategy

Communication templates become crucial here. Draft standard letters explaining the business benefits, technical requirements, and timeline expectations. Most carriers understand the operational advantages but worry about implementation costs and disruption.

Technical support requirements vary by carrier maturity. Large carriers typically have dedicated API teams, while smaller ones might need more hand-holding. Plan for 2-3 months of parallel operation during each migration.

Fallback procedures prevent disasters. If API integrations fail, your gateway automatically routes transactions back to EDI. Live monitoring & rollback – trigger alerts on the first failed call and fall back to EDI until success rates stay above 99.9 %. Addressing these points first makes a Hybrid Approach far less risky.

Phase 5 - Optimization and Full Integration (Months 19-24)

By now, you have a robust hybrid environment handling both EDI and API connections seamlessly. This phase focuses on advanced features like webhook implementations, event-driven architecture, and automated exception handling.

Webhook implementation enables real-time inventory updates and shipment status changes. Instead of polling for updates every 15 minutes, your system receives instant notifications when shipments are loaded, delivered, or delayed.

Advanced Integration Patterns

Event-driven architecture transforms how your logistics operations respond to changes. When a carrier API reports a delivery delay, your system can automatically notify customers, adjust downstream appointments, and update inventory availability - all without human intervention.

Performance monitoring becomes critical at scale. Track API response times, error rates, and failover frequency. Modern platforms like Cargoson, alongside enterprise solutions like SAP TM and Oracle TM, provide comprehensive analytics dashboards for this purpose.

Optimization opportunities emerge from the data. APIs provide much richer information than EDI - GPS coordinates, fuel consumption, driver status, and real-time traffic impacts. Use this data to improve route planning and carrier selection algorithms.

Cost Analysis and ROI Expectations

Let's talk real numbers. Look for sub-USD 500/month packages that bundle pre-mapped templates for orders (850), inventory (846), and shipments (856), with the option to plug into a cloud hub or gateway for smaller implementations.

Enterprise pricing typically starting at $50,000-$250,000 annually, with additional costs for specific modules and implementation covers comprehensive TMS platforms with built-in hybrid capabilities.

More accessible pilot projects begin in the low five figures. A single-carrier API integration with fallback EDI support typically costs $15,000-$25,000 including development and testing. Full transformations covering 50+ carriers range from $150,000-$500,000 depending on complexity and system requirements.

Hidden Costs to Consider

Staff training requires more investment than most companies anticipate. Your EDI specialists need to understand API protocols, error handling, and monitoring tools. Plan for 40-60 hours of training per team member.

Ongoing maintenance shifts from EDI VAN fees to API monitoring, security updates, and partner relationship management. Budget 15-20% of initial implementation costs annually for maintenance and upgrades.

Integration testing and validation efforts multiply with each new API connection. Unlike EDI's standardized formats, every carrier API requires custom validation rules and error handling. Factor in 2-4 weeks of testing per carrier migration.

The payoff justifies the investment. Modern transport tender management through TMS platforms can reduce procurement cycle times by 60% while delivering measurable cost savings. A European retail chain I worked with achieved 8% total cost savings while improving service quality scores.

Your hybrid EDI-to-API migration roadmap provides the flexibility to modernize gradually while maintaining operational stability. Start with Phase 1 assessment this month, and you'll have a robust hybrid environment processing both EDI and API transactions by next year. The key is patience, thorough planning, and choosing the right technology partners who understand both protocols.