Cut Carrier API Integration Time by 60%: The Complete Guide for European Manufacturers and Wholesalers in 2025

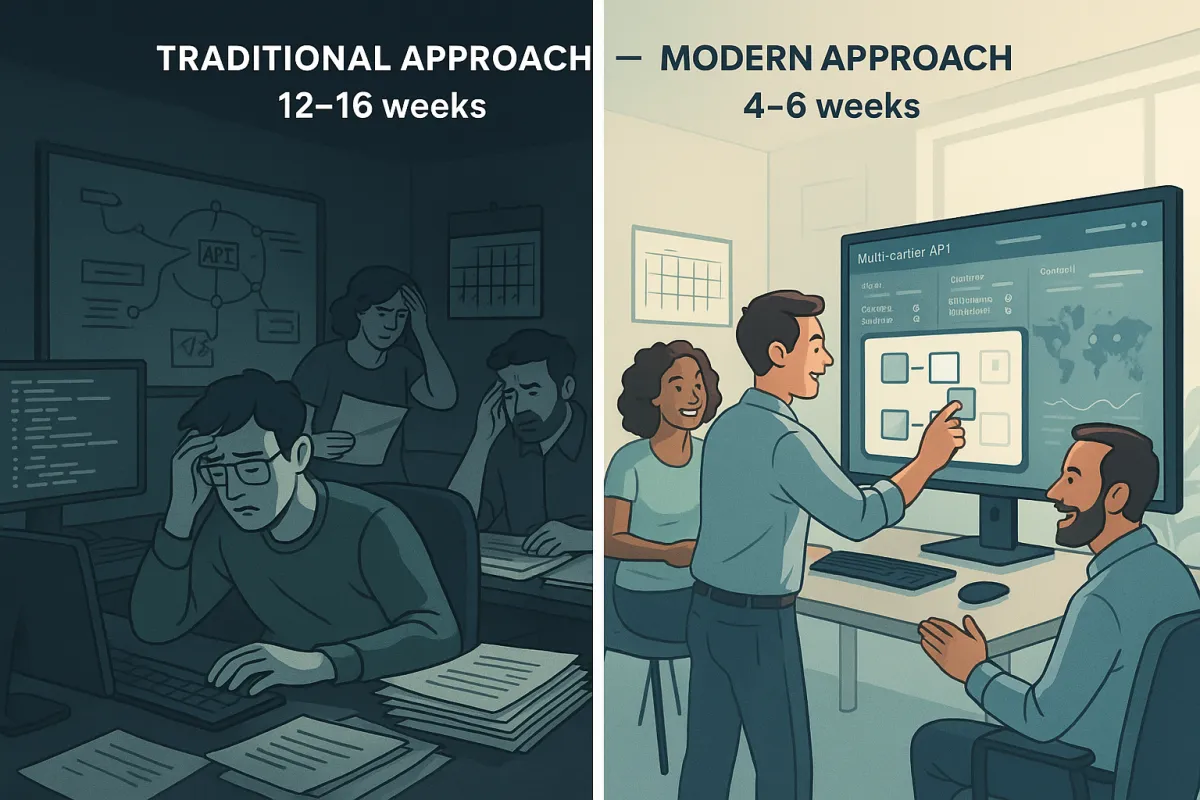

Most European manufacturers spend 12-16 weeks implementing a single carrier API integration. Your procurement team negotiates rates, your IT team builds the connection, then three months later you're finally shipping. Meanwhile, your competitors are already onboarding their next carrier partner.

The problem isn't technical complexity - it's the approach. Carrier APIs are in constant flux, with changes and updates being a regular part of their lifecycle. In an industry as time-sensitive as transport and logistics, keeping pace with these changes could mean constant vigilance — an API being down for even a day can result in significant disruptions. This creates a cycle where each integration feels like starting from scratch.

But here's what I've learned after integrating 200+ carrier APIs: the same project that takes 12 weeks using traditional methods can be completed in 4-6 weeks with the right framework. This isn't about cutting corners - it's about recognizing that most carrier API integration challenges are already solved problems.

Why Standard Carrier API Integration Takes 3+ Months (And Costs More Than They Should)

Your average carrier API integration project follows a predictable timeline: 2-3 weeks for requirements gathering, 4-6 weeks for development, 2-3 weeks for testing, and another 2-4 weeks for deployment and troubleshooting. The average cost of API development ranging from $10,000 to $25,000, and that's just for the technical work.

Add your internal resources - project manager time, developer hours, testing cycles - and you're looking at $37,500 to build an API app, though the total cost can be as low as $25,000 or as high as $50,000 per carrier. For a mid-sized manufacturer working with 10-15 carriers? You're approaching half a million in integration costs alone.

The bigger cost is opportunity. While your team spends months on DHL integration, your competitor is already shipping with both DHL and DB Schenker. While you're debugging Maersk API calls, they're comparing rates across six ocean freight providers in real-time.

The Hidden Costs of Extended Integration Projects

Beyond the obvious development costs, extended API integration projects create hidden expenses that many organizations miss in their initial budgets. Your senior developers get pulled into "quick fixes" that stretch for weeks. Your operations team manually processes orders that should be automated. Your customer service team fields delivery questions they can't answer because tracking isn't integrated yet.

Then there's the testing overhead. Each carrier API update - and major carriers like UPS and FedEx have been migrating to OAuth 2.0 throughout 2024 - requires regression testing across your entire integration. One API change can trigger weeks of additional work across multiple carrier connections.

Modern Integration Approaches That Cut Timeline to 4-6 Weeks

The shift from EDI to RESTful APIs should be making integrations faster, not slower. API carrier integration allows your internal e-commerce systems to talk to those of your shipping carrier. Your developers use the carrier's Application Program Interface (API) to integrate and customize new carrier products inside the company's internal systems, which is inherently simpler than EDI file exchanges.

Multi-carrier API platforms have changed the game entirely. Instead of building individual connections to UPS, FedEx, DHL, and DB Schenker, you integrate once with a platform that maintains all these connections. Ship, track, and return with 200+ carriers, discounted rates, and enterprise-grade performance through a single API endpoint.

Solutions like Cargoson, nShift, ShipEngine, and EasyPost offer pre-built connections that eliminate 80% of the custom development work. You're no longer debugging individual carrier API specifications - you're configuring business rules through standardized interfaces.

Pre-built Integration Platforms vs. Custom Development

The build vs. buy decision comes down to your carrier mix and volume requirements. Custom development makes sense when you're working with regional carriers without API support or when you need highly specialized functionality that platforms don't offer.

But for most European manufacturers, pre-built platforms provide better value. Customer stories show "20-30% less time per day ordering transport" and "small shipment prices with APIs are showing up automatically and cargo prices we get much faster than if we would use regular e-mail requests." The ROI calculation is straightforward: if a platform saves 2-3 hours of manual work per day, it pays for itself within weeks.

The 6-Stage Fast-Track Integration Framework

After managing dozens of carrier API projects, I've developed a framework that consistently delivers integrations in 4-6 weeks instead of 12-16. The key is parallelizing work that traditionally happens sequentially and front-loading the most complex decisions.

Stage 1: Integration Strategy and Carrier Prioritization (Week 1)

Don't start with the carriers your procurement team just negotiated with. Start with the carriers that represent 60-70% of your shipping volume. This means you'll see immediate ROI from your integration work rather than waiting until all carriers are connected.

Stage 2: Technical Architecture Planning (Week 1-2)

Most teams spend weeks debating API architecture. Instead, adopt proven patterns. If you're using a multi-carrier platform, this is largely decided for you. For custom integrations, standardize on REST APIs with OAuth 2.0 authentication from the start.

Stage 3: Authentication and Security Setup (Week 2)

UPS is replacing its entire existing API infrastructure with OAuth 2.0 security model, requiring a bearer token for every API request. From June 5, 2023, no new access keys will be distributed, and post-June 3, 2024, any transaction with UPS will mandate this new OAuth security model. Set up OAuth 2.0 for all carrier connections immediately, even if some carriers still support legacy authentication methods.

Stage 4: Parallel Development and Testing (Week 2-4)

While your primary team works on core functionality, run parallel workstreams for data mapping, error handling, and webhook setup. This is where pre-built platforms shine - you can configure multiple carriers simultaneously rather than building each integration sequentially.

Stage 5: Phased Rollout (Week 5)

Start with your highest-volume, most reliable carrier. Get real orders flowing through the system before adding complexity. This approach catches integration issues early when they're easier to fix.

Stage 6: Monitoring and Optimization (Week 6+)

Carrier integration brings in an array of data and analytics that can be used for informed decision-making in logistics operations. With shipping performance metrics, delivery times, first-attempt delivery rates, etc., you can identify areas for improvement and optimize your carrier mix based on actual performance data.

Avoiding the OAuth 2.0 Migration Trap

The industry-wide migration to OAuth 2.0 authentication has created a massive integration trap for companies using legacy approaches. FedEx developers have until May 15, 2024 to adopt the improved FedEx API, at which point previous SOAP APIs will become completely inaccessible. Developers are increasingly leaning towards REST APIs, thanks to their flexibility and efficiency. Acknowledging this trend, FedEx has crafted modernized REST APIs to replace their older SOAP-based systems.

Here's the technical reality: if you built UPS integrations using the old access key system, those connections stopped working after June 2024. If you're still using FedEx SOAP APIs, they become inaccessible after May 2024. This isn't a gradual deprecation - it's a hard cutoff.

The solution isn't just updating authentication methods. UPS is transitioning to a true RESTful pattern, offering more flexibility. Any prior integrations, be it XML, SOAP, or legacy JSON payloads, will necessitate a complete transformation to align with UPS's RESTful APIs from their new API catalog.

Integration Challenges Specific to European Manufacturers

European manufacturers face unique integration challenges that don't affect their North American counterparts. You're working with carriers that span 27+ countries, each with different documentation requirements, customs procedures, and delivery networks.

The ERP landscape adds another layer of complexity. SAP dominates large enterprises, but mid-market manufacturers use dozens of different systems - Microsoft Dynamics, Sage, Epicor, and hundreds of industry-specific solutions. Your ERP system may have some pre-built carrier plugins available, but these tend to support only the large carriers, and only parcels, not the freight shipping that many manufacturers require.

This creates a development nightmare. Each ERP system has different data formats, integration patterns, and API capabilities. A UPS integration that works perfectly with SAP might require complete rewrite for a Dynamics 365 environment.

ERP Integration Bottlenecks and Workarounds

Most ERP integration delays stem from data mapping challenges. Your ERP stores product dimensions in millimeters while carrier APIs expect inches. Your system tracks weight in grams while carriers want kilograms. These aren't complex technical problems, but they require careful planning and testing.

The fastest approach is middleware that handles all data transformation outside your ERP system. This lets you integrate carriers without modifying core business systems, and it creates a reusable pattern for future carrier additions.

Cost Optimization Strategies for Faster Integrations

Smart procurement can cut integration costs by 40-60% without sacrificing functionality. The key is understanding when to use different types of service providers and how to structure contracts for ongoing maintenance.

For carriers with robust API support (UPS, FedEx, DHL, DB Schenker), multi-carrier platforms like Cargoson, nShift, or ShipEngine provide the best value. You're paying for proven integrations, ongoing maintenance, and carrier relationship management - work that would otherwise consume internal resources.

For regional carriers or specialized freight providers, system integrators often provide better value than in-house development. They have experience with multiple carrier APIs and can apply lessons learned across projects.

Build vs. Buy Decision Matrix

The decision matrix is simpler than most teams make it. If you're shipping less than 10,000 orders per month and working with major carriers, buy a platform solution. Add shipping into any 3PL, WMS, ERP, marketplace, or custom system in minutes, not months using established integrations.

Build custom integrations when you have specific requirements that platforms can't meet: complex routing logic, specialized documentation requirements, or integration with carriers that don't offer API access. But even then, consider hybrid approaches where platforms handle standard carriers and custom code manages exceptions.

Future-Proofing Your Carrier Integration Strategy

The shipping industry's digital transformation is accelerating, not slowing down. APIs are becoming more sophisticated, with real-time tracking, predictive analytics, and automated exception handling becoming standard features rather than premium add-ons.

Your integration architecture needs to accommodate these advances without requiring complete rebuilds. This means API-first designs, standardized data formats, and integration patterns that can adapt to new carrier capabilities.

Consider how modern TMS systems like Cargoson are building carrier connectivity into their core platforms rather than treating it as an add-on feature. This approach provides better scalability and reduces the technical debt that accumulates with custom integrations.

Preparing for Next-Generation Logistics Technologies

The next wave of logistics technology will integrate IoT sensors, AI-powered routing, and blockchain-based documentation. Your carrier integration architecture should support these capabilities without requiring fundamental changes.

This means designing APIs with webhook support for real-time updates, standardized event formats for tracking data, and flexible authentication that can accommodate new security requirements. Carrier integration opens a real-time window into the shipment process and each stage of the delivery journey. Accurate status updates create more supply chain transparency, higher customer satisfaction and increased operational control.

Success Metrics and Monitoring Framework

Measuring integration success requires more than just "did it work?" You need metrics that demonstrate business value and identify optimization opportunities.

Start with operational metrics: order processing time, shipping cost per order, delivery performance by carrier. These provide immediate feedback on integration effectiveness and help justify the investment in faster implementation approaches.

Add technical metrics: API response times, error rates, webhook delivery success. These help you identify carriers with integration issues before they impact operations.

The most important metric is time-to-value: how quickly new carrier integrations start generating business benefits. With traditional approaches, this often takes 4-6 months from project start to measurable results. Fast-track approaches can deliver value within 6-8 weeks.

Ready to cut your next carrier API integration timeline in half? Start by auditing your current integration approach against the framework outlined above. Modern shipping API integration doesn't have to take months when you apply the right strategies and leverage proven platforms rather than building everything from scratch.