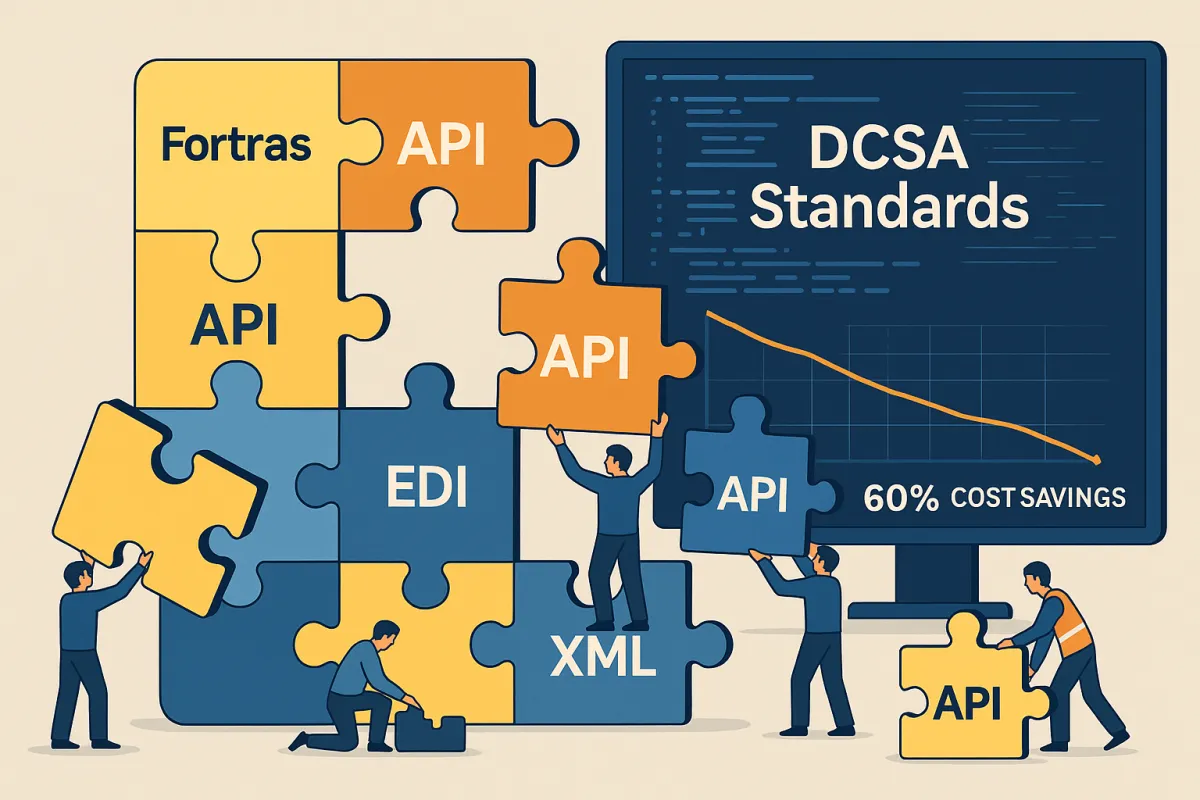

API Standardization Revolution 2026: How European Shippers Can Cut Carrier Integration Costs by 60% Using DCSA Standards and Modern TMS Architecture

Your TMS budget just hit a wall. A mid-sized German automotive parts manufacturer discovered the hard way what happens when TMS hidden costs aren't properly budgeted. Six months into implementation, €800,000 spent, they realized their new system couldn't handle their complex carrier network across 12 countries. Now they're starting over, but this time with a different problem: their European carriers still use proprietary EDI variants while new API standards promise to slash integration costs by 60%.

This basic API integrations cost €5,000-€15,000, while complex ERP connections exceed €50,000. A basic domestic shipper requires 10-15 integrations minimum, potentially totaling 1,000-1,500 hours of labor. For companies managing significant European freight networks, these numbers multiply fast. The math becomes stark: traditional integration approaches trap you in expensive custom development cycles that compound with every new carrier relationship.

The €200,000 Integration Problem: Why European Shippers Are Trapped by Fragmented Carrier Standards

European shippers face a brutal reality that TMS vendors downplay during sales presentations: many carriers aren't willing or able to create API connections, and even when they are, they'll charge integration costs to you. European shippers working with 20-30 regular carriers face substantial connectivity expenses that vendors rarely discuss during initial demos.

The fragmentation runs deeper than most IT directors realize. While enterprise solutions like MercuryGate and Descartes promise comprehensive connectivity, they often require carriers to implement standard EDI messages themselves – shifting development costs to your transport partners. Meanwhile, Transporeon and nShift require carriers to implement standard EDI interfaces themselves, while Cargoson builds true API/EDI connections with carriers rather than requiring standardized EDI messages that carriers must implement.

Consider the true cost calculation: base licensing (20-30% of total), implementation services (25-40%), carrier integration (15-25%), customization and training (10-20%), and ongoing support (15-20%). For a typical European operation requiring 25 carrier integrations, you're looking at €125,000-€375,000 in connectivity costs alone – before considering ongoing maintenance when carriers update their systems or change requirements.

The Technical Reality: EDI vs API Chaos Across European Carriers

The European carrier landscape operates on a patchwork of incompatible standards. German carriers often rely on FORTRAS messaging, while French logistics providers have developed their own XML variations. Scandinavian operators favor EDI subsets that don't align with Mediterranean shipping protocols.

This creates a nightmare scenario for TMS implementations. While many TMS solutions offer published APIs, carriers are often unwilling or unable to create connections themselves, and even when they can, they typically charge integration costs back to the shipper. These charges vary dramatically by provider approach.

Modern TMS platforms like Cargoson address this by building genuine API and EDI connections rather than requiring standardized messages. This approach eliminates the carrier development burden while ensuring reliable connectivity across diverse European transport networks.

DCSA Standards: The Game-Changing Solution for Multi-Carrier Integration

MSC has confirmed its adoption of the Digital Container Shipping Association (DCSA) Commercial Schedules API, providing customers and partners with real-time access to standardised vessel schedule data through direct system integration. This isn't just another shipping technology announcement – it represents the first major breakthrough in carrier API standardization that European shippers can leverage immediately.

With the DCSA Commercial Schedules API, you'll get: A standard format that makes working with multiple carriers easier. Schedule information that goes straight into your systems, reducing the need for manual checks or data entry. Accurate, real-time data to help with better planning and reduce the risk of supply chain disruption.

The business impact becomes clear when you consider current integration complexity. This standard ensures that all stakeholders, including beneficial cargo owners (BCOs), freight forwarders (FFWs), and solution providers, can access consistent, high-quality data, regardless of their chosen carrier. Instead of building 15 custom integrations at €15,000 each, you build five custom connections plus ten standardized APIs at €2,000 each.

We're also adopting the DCSA Booking 2.0 API and the DCSA Bill of Lading 3.0 API to offer a fully digital, API-based customer experience. MSC's commitment signals broader industry adoption, with other carriers following similar implementation roadmaps through 2026.

Beyond Ocean Freight: How DCSA Principles Apply to Road, Rail, and Air Transport

While DCSA standards originated in container shipping, the standardization principles extend across European transport modes. This digital shift will apply to road, rail, inland waterway, and air transport. It will reduce administrative burdens for operators and authorities, enhance data security, and ensure compliance with EU and national freight regulations.

The eFTI Regulation creates similar standardization pressure for land-based transport. By creating common standards and making systems work together, eFTI paves the way for fully paperless transport in the EU. European TMS providers building for these standards position themselves for sustainable competitive advantage.

Forward-thinking platforms like Cargoson, Transporeon, and nShift are already incorporating these compliance frameworks into their core architecture, while legacy systems face expensive retrofitting to meet mandatory requirements.

Implementation Strategy: Building Your API Standardization Roadmap

Smart European shippers approach API standardization with a phased migration strategy rather than attempting wholesale system replacement. Start by auditing your current carrier mix: identify which partners already support or plan DCSA-compliant APIs, map integration complexity for remaining connections, and prioritize highest-cost custom integrations for early migration.

Build hybrid architecture that supports both standards-based and legacy connections simultaneously. This allows you to capture immediate cost savings from standardized APIs while maintaining operational continuity through existing EDI relationships. Modern platforms handle this seamlessly – you're not forced into all-or-nothing migration scenarios.

Phase your migration to prioritize maximum financial impact. Start with carriers representing the highest integration maintenance costs, typically those requiring frequent API updates or complex custom development. The Track and Trace API, unlike EDI, enables real time exchange of data and communication of events to the end user. This also helps them receive accurate exception notifications of the cargo journey.

Consider TMS providers with different approaches to carrier connectivity: enterprise solutions like Manhattan Active require significant customization, while European-focused platforms like Cargoson provide pre-built integrations that reduce implementation risk and accelerate standardization benefits.

The 60% Cost Reduction Math: Real Numbers from Early Adopters

Let's quantify the standardization savings with realistic scenarios. Traditional approach: €15,000 per carrier integration × 20 carriers = €300,000 total integration cost. Standards-based approach: €15,000 × 5 custom integrations + €2,000 × 15 DCSA-compliant APIs = €105,000 total cost. This 65% reduction excludes ongoing maintenance savings, which typically add another 15-20% annually to custom integration expenses.

The calculation improves further when considering maintenance cycles. Custom integrations require updates every 18-24 months as carriers modify their systems, while standardized APIs maintain backward compatibility and reduce support complexity. Early DCSA adopters report 40% lower ongoing connectivity costs compared to proprietary integration maintenance.

These numbers reflect real-world implementations, not theoretical maximum savings. Conservative estimates suggest 45-60% cost reductions for companies with substantial carrier networks, while smaller operations with focused geographic coverage see 30-40% savings through selective standardization.

Future-Proofing Your TMS: What's Coming in 2026-2027

As of 9 July 2027: The eFTI Regulation will apply in full. Member State authorities must accept information shared electronically by operators via certified eFTI platforms. This timeline creates both compliance necessity and procurement opportunity for European shippers evaluating TMS investments.

By September 2025: The Commission plans to adopt the remaining eFTI implementing specifications. These will provide detailed functional and technical requirements for the IT systems and services to be used by businesses (eFTI platforms and eFTI service providers) and the rules for their certification. The regulatory framework accelerates beyond ocean freight into comprehensive multimodal standardization.

This successful interoperable eBL transaction represents a breakthrough in addressing these challenges, powered by DCSA's interoperability framework with three essential components: Platform Interoperability (PINT) API – Standardised integration enabling transfer of DCSA-compliant eBLs between solution providers. Document interoperability becomes reality, not wishful thinking.

European TMS platforms building for these standards gain significant competitive advantage. It could save the EU transport and logistics sector up to €1 billion per year. This represents massive cost reduction opportunity for companies positioning themselves early in the standardization wave.

Vendor Selection: Choosing TMS Platforms Built for Standardization

Not all TMS vendors approach API standardization equally. Evaluate native DCSA API support versus bolt-on integrations that require separate development cycles. European carrier network coverage through standards-based connections determines your implementation success and ongoing operational costs.

eFTI readiness separates forward-thinking providers from legacy platforms requiring expensive upgrades. Member States authorities may start accepting data stored on certified eFTI platforms for inspection from January 2026. Use this voluntary period for real-world testing and staff training. QR code generation and machine-readable format requirements become mandatory by July 2027. Your TMS must generate these automatically for every shipment across all transport modes.

Compare total cost of ownership including hidden integration fees. Enterprise platforms like MercuryGate and Descartes offer comprehensive functionality but require significant implementation investments. European-focused alternatives like Cargoson provide built-in standards compliance and pre-connected carrier networks, while simpler tools like ShipStation lack the enterprise integration capabilities for complex European operations.

Choose platforms with proven standardization track records. Look for existing DCSA implementations, eFTI compliance roadmaps, and established European carrier partnerships through standardized APIs rather than custom development requirements. The vendor's approach to standards adoption determines your future connectivity costs and regulatory compliance success.

The API standardization opportunity window closes rapidly as early adopters capture competitive advantage and regulatory deadlines approach. Companies implementing standards-based TMS architecture now position themselves for sustainable cost reduction and operational efficiency gains while competitors struggle with fragmented legacy integration approaches.